Transient Ischemic Attack and Its Impact on Life Insurance Prices

Other related medical conditions (or medical terminology) include Transient Ischemic Attack, TIA, Mini Stroke, Mild Stroke. Read below for more information about Transient Ischemic Attack and receiving a life insurance quote from a life insurance specialist.

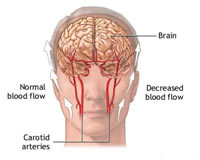

TIAs provide advanced warning of stroke

A person having a TIA may experience a variety of symptoms that begin suddenly, last only a short time and disappear completely within a short period of time. These symptoms are called neurological deficits and occur when there is a brief interruption in blood flow to the brain. Symptoms may include:

- temporary numbness

- tingling or weakness of the extremities

- eye pain or loss of vision in one eye; decreased or double vision

- garbled or slurred speech

- loss of balance and/or coordination

- dizziness

- falling or staggering caused by weakness in legs

- confusion

- facial paralysis

A TIA is different than a “small” stroke because its symptoms usually disappear in less than 24 hours, sometimes before the victim can even be seen by a physician. TIAs are often diagnosed based upon a personal medical history along with the patient’s description of the event. A TIA should be treated as a warning that a person is at risk for a full stroke in the future and preventive treatment should be sought.

When blood supply to the brain is blocked due to a temporary blockage of a cerebral or carotid artery, a TIA occurs. Identifying a TIA usually requires admission to the hospital for evaluation of the specific cause if the TIA happened within the previous 48 hours.

Common causes of TIA include:

- Narrowing of a blood vessel

- Blood clot within an artery of the brain

- Blood clot that travels to the brain from somewhere else in the body

- Injury to blood vessels

- Artherosclerosis, “hardening of the arteries,” caused by fatty deposits on the inner lining of arteries

Less common causes of TIA include:

- Blood disorders

- Spasm of the small arteries in the brain

- Problems with blood vessels caused by disorders such as fibromuscular dysplasia, inflammation of the arteries, systemic lupus erythematosus, and syphilis

Diagnosis and treatment of TIA

While conducting the physical examination, the doctor will check the heart and carotid arteries to listen for irregular blood flow sounds if blood pressure is elevated. These sounds are called bruits. The doctor will also be looking for signs of underlying disorders such as hypertension, heart disease, diabetes, arthritis, and blood disorders. The physician will also do a neurological exam.

Once a TIA is confirmed, the goal of treatment will be to improve the arterial blood supply to the brain and prevent the development of a stroke at a later date. Treatment targeting improved overall health may include:

- Medications

- Blood thinners

- Dietary changes

- Aspirin therapy

- Surgery

- Treatment of blood disorders

Applying for insurance after a TIA

When you apply for insurance after a TIA, insurers will consider the diagnosed cause of the TIA, the patient’s age, the number of TIA episodes, the time elapsed since the last episode and the course of treatment when evaluating your application. An ultrasound study will probably be requested along with the medical history. A waiting period of six months after a single episode of TIA, or up to one year following a recurrent TIA, is usual before approval. If there are other co-existing diseases to consider, like cardiovascular vascular disease, applicants should present documentation of medical follow-up, regular exercise, cessation of smoking, improved nutrition and all medications taken to reduce stroke risk. Individuals who have successfully undergone surgery to correct blockages will have to wait three to six months for approval. Individuals with significant blockages or a history of TIA will find it difficult to obtain insurance.

How Can MEG Financial Help?

At MEG Financial, we have worked with many individuals across the country that have had related histories and have helped many obtain fairly priced life insurance. A number of these clients previously attempted to buy life insurance elsewhere but were either turned down or asked to pay a significantly higher rate. Our experience helping others with related problems is invaluable to you in identifying the insurance company that will treat you most fairly.

For more specific information or to obtain a custom quote, call MEG Financial today at (877) 583-3955. You may also submit this short form and an independent insurance agent will personally contact you to go over any questions or other concerns.

Speak with an experienced advisor!

Speak with an experienced advisor!